If you’ve been living under a rock or in a place without any connection to the outside world, we are in a recession. It was official already though some still think there is one to come. But by definition, the United States is in a recession.

With the government raising rates, inflation at an all-time high, and consumer prices going out of control, it’s really hard to even think about investing and saving for retirement. I mean grocery prices are up about 12% since the start of this year and continue to rise every month it seems.

It’s hard to make ends meet for some, especially those who rent and are seeing massive rent increases.

So, when it comes to investing, should you sell now or wait it out?

This information is purely informational. I am not a financial advisor and do not give out personal investment advice.

The Best Time to Invest is Now

I’m sure you’ve heard this before, right?

The best time to invest is now and I used to laugh about that. I also used to time the market to “buy the dips”, but then realized you never can properly time the dips.

But I do believe that if you are not investing, you have little chance in reaching retirement with the money needed to live comfortably. How much you invest is completely up to you though. You need to weigh your risks and diversify your money.

Important – if you are near retirement, then you should consult with your financial advisor as investing now might cause you to lose more of your upcoming nest egg.

Make sure you have a good emergency fund, can pay all your bills, and then take some of that leftover money per month and invest in the markets.

Should Your Keep Investing In a Down Market?

In my opinion, I would definitely keep investing when the stock market is down. History has shown us over all the decades that the market does return a positive percentage, but we have several big down years. Not everything is up and up like the past few years before this year (2022).

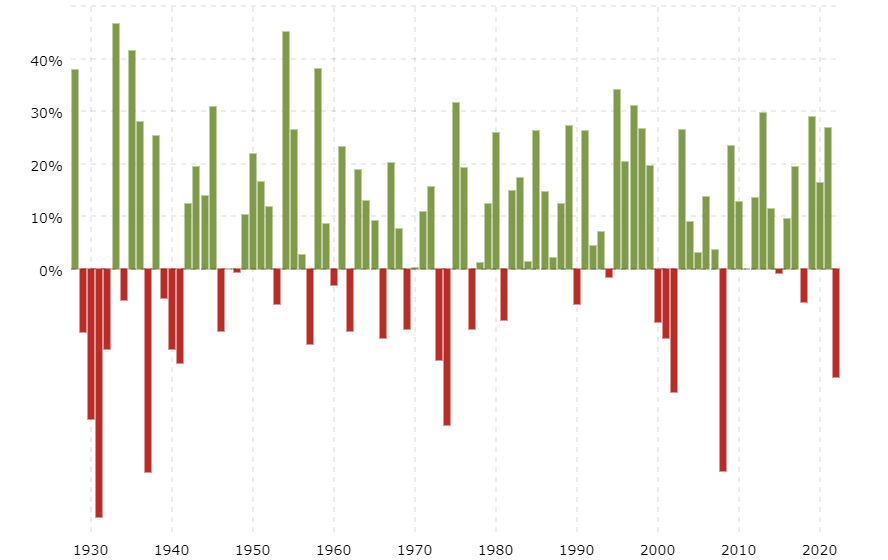

Here is a good graph for you of the S&P 500 and you can see the ups and downs of the market, but historically, it’s returned close to 10% annually.

Even with all the ups and downs, I do think it’s smart to keep investing when the market is down. You can’t win buying high and selling low and it’s extremely important to disconnect your emotions from investing. You invest based on math and keeping your emotions out of it. It’s hard to see your portfolio lose $30,000 in one day like mine did last week, but I keep the course and keep investing. I have faith the market will turn around in a few years and hopefully the money I invest now will grow exponentially.

To keep my life simple, I invest in index funds that track the markets. I rarely do single stocks as I like the diversification the index funds and ETFs give me.

So, in short, I think you should keep investing when the market is down as this is your chance to “buy low” and hopefully when the time is right, you can “sell high” and enjoy the profits.

But personal finance is personal, so you have to do what is within your risk tolerance.

The post Should I Keep Investing When the Stock Market is Down? appeared first on Debt RoundUp, the content owner.